Have any question?

Welcome to African Diaspora Asset Managers

The first-ever diaspora-focused Fund Manager in Kenya

African Diaspora Asset Managers (ADAM) Capital is the first-ever diaspora-focused Fund Manager in Kenya, providing innovative investment solutions and optimized returns to our clients. Licensed by the Capital Markets Authority and the Retirement Benefits Authority of Kenya, ADAM Capital is committed to empowering individuals and institutions to achieve their financial goals through a trusted and competitive suite of financial services.

OUR CORE OFFERINGS

-

1. ADAM Property Fund

The Property Fund is a revolutionary investment fund designed to provide investors with diversified opportunities within the Kenyan real estate market. Managed by ADAM Capital, the fund offers three distinct investment channels: Shamba Digital, Nyumba Digital, and ADAM Off-Takers. Interestingly, data analytics by realtors prove that over 80% of people buying land and houses in Kenya are average income-earners holding the bottom of the economic pyramid. Unsurprisingly up to 50% to 70% of these buyers end up defaulting repayments, faltering the success cycle of the real estate industry. The ADAM Property Fund comes as a resolute joinder of this by supplying realtors with a financing resource and creating an environment of ease of purchase for the buyers. To enhance the efficiency, ADAM integrates with an e-Jenga system, a construction tracking software designed to monitor the entire lifecycle of the construction process, from resource acquisition to completion and project signoff.

-

Shamba Digital

A land purchase model that allows investors to acquire land with low initial deposits and flexible payment plans.

-

Nyumba Digital

A similar model for purchasing houses and properties

-

Off-Takers

A platform for sellers to offload completed or ongoing real estate projects

-

Rent Pesa

A digital rent collection service that streamlines the rental process and ensures timely tax remittance.

● Initial Deposit: 30% (with 10% invested in the ADAM Money Markets as a Security Guarantee,

generating you returns of up to 15% per calendar year)

● Repayment: 10-year in daily, weekly, or monthly installments.

● Financing: KCB Mortgage Business finances the remaining 70% at prevailing market rates.

● Players: Real Estate Association of Kenya |KCB Bank | Land Buyers | ADAM

● Initial Deposit: 10% paid to ADAM as an Investment Guarantee (generating you returns of up to

15% per calendar year)

● Repayment: 20 years in daily, weekly, or monthly installments.

● Financing: 100% financing by KCB Bank.

● Players: Developers | Contractors | Home Builders | Buyers | ADAM

● A platform for sellers to find buyers for completed or ongoing real estate projects.

● Players: Property Sellers | KCB Bank | Buyers | ADAM

● Automated rent collection through MPESA, Visa, or MasterCard.

● Tax remittance to KRA on behalf of landlords.

● Enhanced rental unit monitoring for owners and landlords.

-

Executive Services

Personalized investment advice and portfolio management tailored to individual needs and risk tolerance. Built for high net-worth individuals and corporations.

-

Money Market Fund

A low-risk investment option that provides liquidity and stable returns. Includes investments in Equities, Swaps, Global Funds, Foreign Exchange, and Derivatives.

-

Special Purpose Fund

Focused on specific investment themes or opportunities with capital requirements of at least KES 500,000.

-

Hedge Fund

Employing sophisticated investment strategies to generate returns in various market conditions for high-level investments. Minimum capital requirements of KES 1,000,000.

-

2. ADAM Wealth Fund

ADAM MMF

Our Money Market Fund is a low-risk and highly liquid investment vehicle that provides

risk-averse investors a safe platform to actively invest their income. Investors can invest any amount of

money at any time and access their portfolio reports from the comfort of their homes. Funds are available

to the investors within 48 hours from the withdrawal request time.

ADAM FIXED INCOME FUND

Our fixed income fund enables investors to create a steady passive

income from their investment. The fund is structured to preserve capital and hold investment over a

medium to long term. Investors mainly use this fund to save for a purpose, and typically choose to

reinvest the income as they grow their funds. Investors register, invest, track performance of the fund and

make withdrawal requests through their Mobile app, using the USSD code, and on our web platform.

ADAM BALANCED FUND

Our Balanced fund is designed for moderate risk investors looking for faster

capital appreciation. It provides a mix of carefully selected equity stocks and a mix of government paper

and corporate bonds. Investors register, top up, track performance and request for withdrawal of their

respective funds through their mobile phone.

ADAM EQUITY FUND

Our Equity fund is designed for investors with a higher risk appetite and

looking to grow their portfolio through capital appreciation. The fund’s allocation highly favors local and

offshore listed equities. Investment holding horizons are usually longer. Investors register, top up, track

performance and request for withdrawal of their respective funds through our Mobile application

-

3. ADAM Training Division

●Financial literacy programs and workshops to empower individuals and institutions with

investment knowledge.

● Skill transfer initiatives to enhance financial capabilities.

-

Client Centric

We aim to empower the mass market with wealth management tools in a way that recognizes their every-day effort.

MODEL

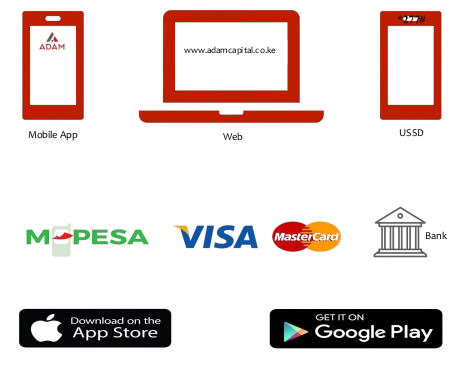

ADAM App

ADAM’s key leverage is in the delivery of easily accessible investment products via a custom-built

mobile App. The ADAM App is a user-friendly mobile application designed for global accessibility with

the following key features:

● Investment Product Access: Clients can easily access and invest in various ADAM products.

● Client Onboarding: A streamlined process for new clients to join the ADAM platform.

● Client Agreement: Clear terms and conditions for investing with ADAM.

● M-Ratiba: Safaricom’s revolutionary technology to enable MPESA users to set up recurring

(standing order) payments from their M-Pesa account to other M-Pesa users. This will enable

property buyers to make payments on a daily, weekly, and monthly basis.

● Users: Investors | Real Estate Association Members | Contractors | Developers | Home Builders

● Payment Options: Convenient payment methods including MPESA, Visa, and MasterCard.

● Global Payment Integration: Seamless integration with global payment aggregators like Tap Tap

Send, STC Pay, and Ooredoo.

Need to reach out ? Call us at

Call +254709488889

Functional Add-Ons:

e-Jenga

-

Centralizes information

Provides a single platform for managing all project-related data.

-

Streamlines processes

Automates routine tasks, reducing administrative burdens.

-

Enhances transparency

Offers real-time visibility into project progress and performance.

-

Improves decision-making

Provides data-driven insights to support informed choices.

OUR TEAM

Meet the People Behind

the High Success

Michael Patrick Foley

Chairman

Michael is a business administration expert with decades of experience in corporate governance. He has worked in wide-ranging corporations as a CEO, including Telenor Group, YU Mobile, and ALOPA Networks Inc.

Wachira Kariuki

Chief Executive Officer

Wachira is a Seasoned Corporate Trailblazer with a distinguished professional profile in the global financial markets.

Moses Kiiru

Chief Financial Officer

Moses Kiiru is a Certified Public Accountant, with over 15 years’ experience in Corporate Finance and Accountancy.

Amos Karanja

Chief Operating Officer

Amos is an experienced corporate administrator, with over 6 years of experience in Procurement, Logistics, Corporate Administration, and Operations. Having held key positions such as Director of Operations & Strategy, Chief Operation Officer, Corporate Admin, and Back Office Associate across diverse industries.

Stephen Kavithi

Risk & Compliance Officer

Stephen is a Certified Public Accountant with over 14 years of experience in auditing, risk management, and corporate compliance. He is also a Certified Anti-Money Laundering Specialist (CAMS), with vast knowledge in mitigating vulnerability to financial crimes.

Jonathan Wambua

Internal Auditor

Jonathan is a Certified Public Accountant with over 5 years of experience in auditing, financial management, accountancy, and taxation.

Caroline

Cluster Head

A seasoned professional with over 12 years of experience spanning marketing, project management, and business development. Caroline has worked across both private and public sectors, forging strategic partnerships with government ministries, public corporations, and private investors.

contact us

Have Questions? Contact

with us Anytime

-

-

Send Email

info@adamcapital.co.ke

-

Visit

1st Floor, Westlands Office Park, Nairobi